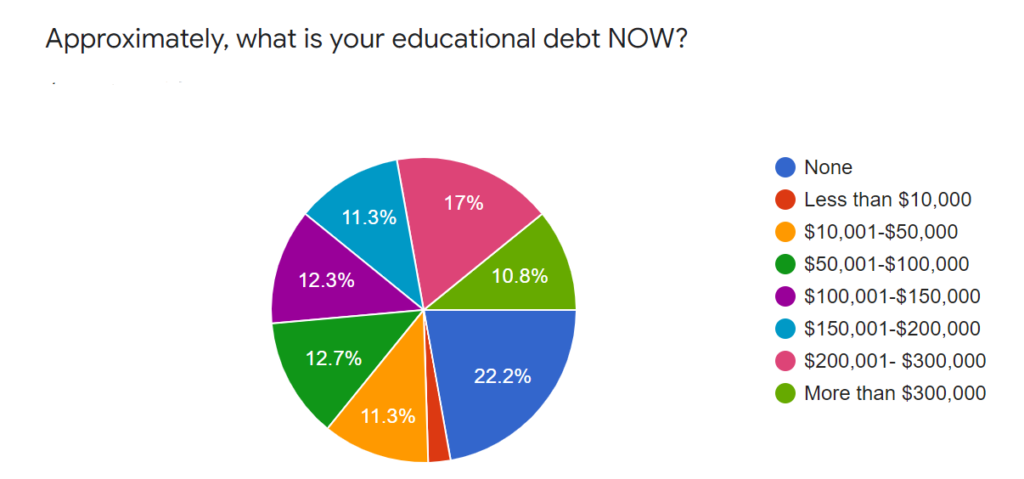

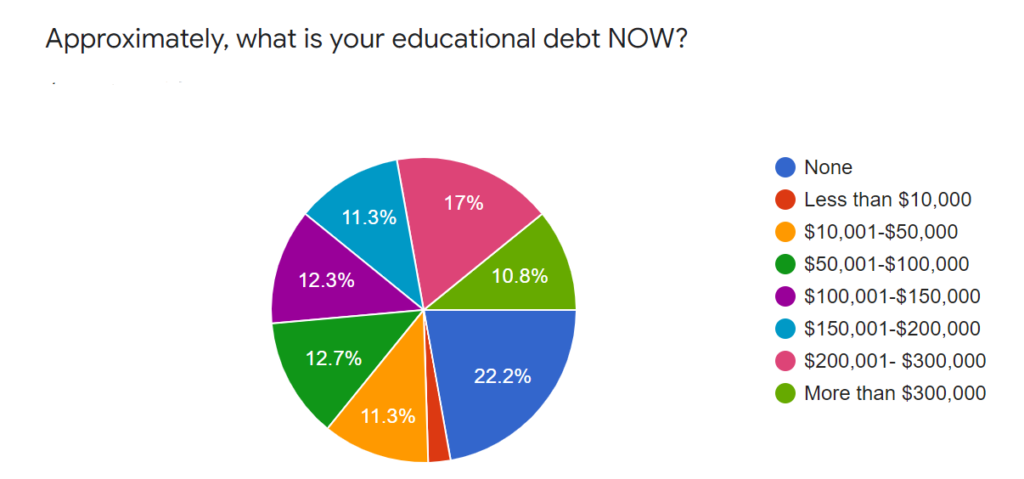

Ninety-six percent of respondents to a WO Pop-up Poll said that they graduated optometry school – or expect to – with student loan debt. While 22 percent of respondents said that they currently carry zero debt, more than one-in-four respondents (28 percent) carry more than $200,000 in student loan debt. Another nearly 24 percent have been between $100,000 and $200,000 now. More than 200 people responded to the WO Pop-up Poll, also shared with Review of Optometric Business readers. Seventy percent of respondents said they were female ODs and 28 percent said they were male OD.

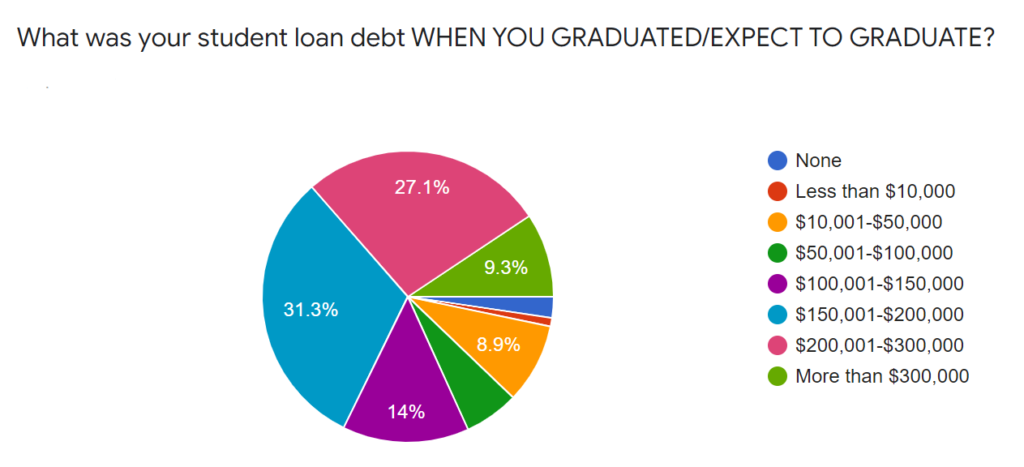

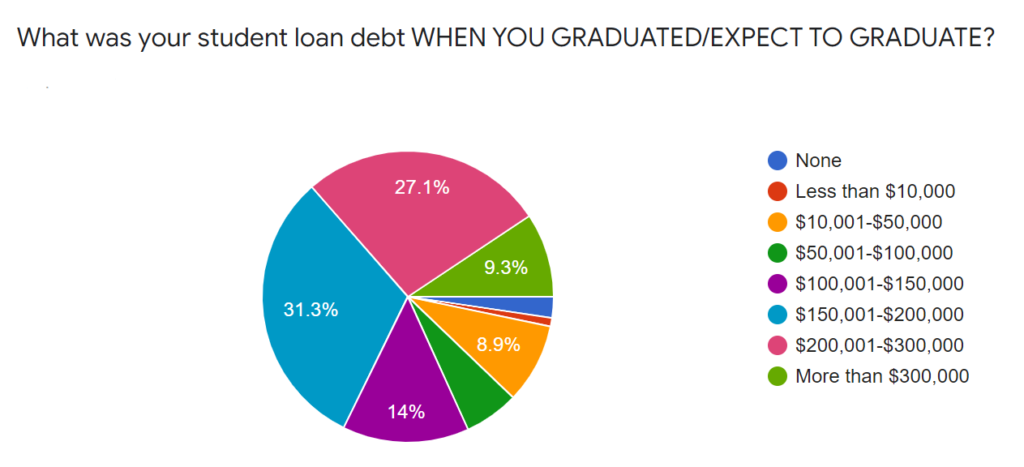

Upon graduation, the average debt load was even larger. Fully 36 percent of respondents said that their student loan debt topped $200,000, with 27 percent saying they owed between $200,000 and $300,000 upon graduation, and nine percent saying they owed more than $300,000. Overall, 68 percent – more than two-thirds of respondents – said they graduated with student debt of more than $150,000.

About 23 percent of the respondents have graduated since 2016, and another 24 percent graduated between 2010-2015. The largest cohort of respondents (32 percent) graduated between 2000-2009.

There were a small number of respondents from the classes of 2021 and 2022, but slightly more than half of them said that they had at least $200,000 worth of debt. Similarly, there were few graduates from the 1980s, but 92 percent of them said that they have a zero student loan debt balance today.

One discouraging finding from this survey was the amount of time that respondents anticipate needing (or choosing) to pay off student loans. Forty-three percent said that they expect it will take (or did take) more than 20 years to pay down student loans, and another 32 percent (16 percent each) said they anticipate paying down debt for 11-15 years or 16-20 years. Overall, six percent of respondents said that they owe more now than when they graduated – moving from one debt bracket into a higher one in a WO data analysis.

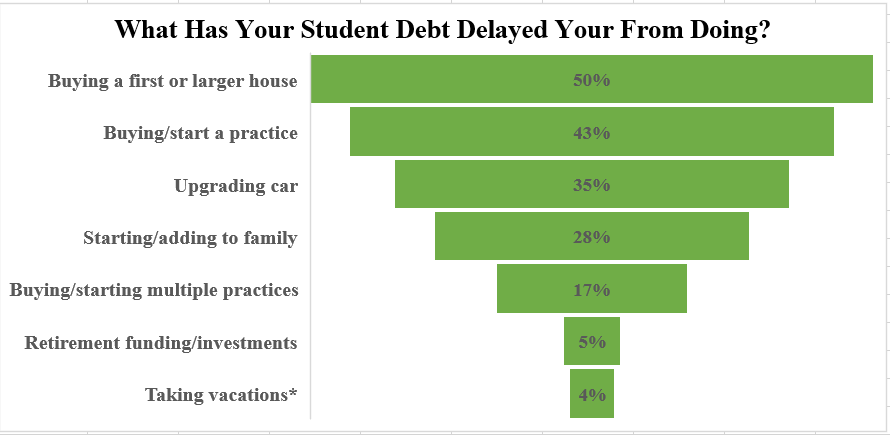

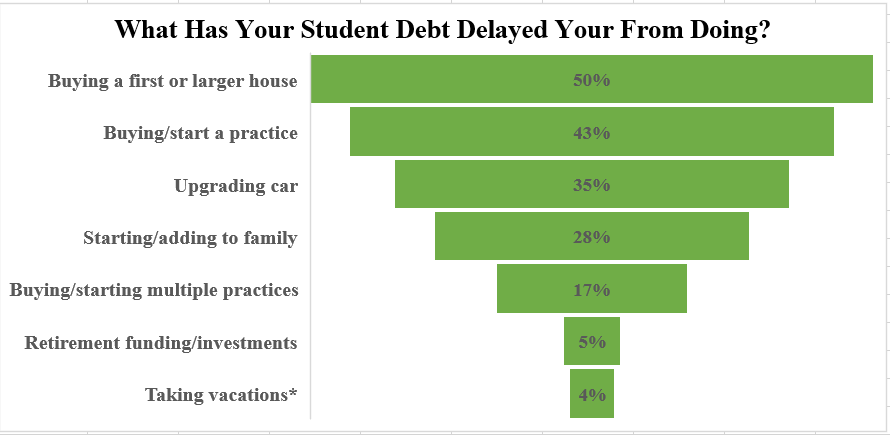

Student loan debt is impacting many respondents’ financial planning for the future.

Read what optometrists say about their debt load.