Every day, I work with high-income ODs who want to create a meaningful nest egg and build wealth outside their practice. While we do in-depth analysis on cash flow, investments and taxes to generate a targeted plan to meet their goals, you can get started by employing a simple formula you can use to guide your spending decisions.

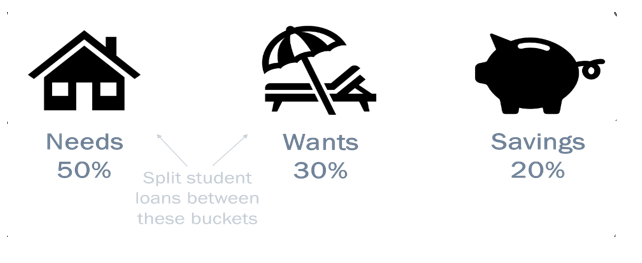

Warning: if you are not currently on a meaningful savings program, this may seem strict. But you can tweak the numbers to fit your situation and work up to more aggressive levels over time. The key is to align your needs, personal wants and savings in approximately these ratios:

Let’s look at how that works for a solo OD grossing $1,000,000 and netting 30%, or $300,000 in pre-tax profits (specifically salary + practice distributions).

Needs = Taxes, Debt and Electricity

Needs should consume no more than 50% of your pre-tax profits, which in this case is $150,000 (50% X $300,000). This would include taxes, your home mortgage and maintenance (I suggest assuming it takes 1% of the market value for maintenance per year), health insurance, utility bills, car payments, student loans as well as the loan to purchase your practice.

This does not include any tax-deductible practice expenses such as equipment or the mortgage or rent on your office building. Those all fall under practice overhead which is paid before you take your salary and year-end distribution.

For most ODs, this number will start high and decrease as debt is paid off. This doesn’t mean you should go buy a bigger house or new car right away. As your needs shift, its important balance the difference between wants and savings to avoid a “lifestyle gap”, which is when your annual spending exceeds what your retirement savings can provide.

Managing Your Wants

Wants is basically your lifestyle spending. This category should consume no more than 30% of your pre-tax profits, which in this case is $100,000 (30% X $1,000,000).

The Wants category includes all your personal expenses such as food, gym memberships, country club dues, vacation travel/homes, college tuition, cars, boats and clothing. In short, all your necessities, fun and games go here. Wants also includes personal items paid through your practice such as health insurance or auto expenses.

$100,000 may not seem like a big number to live on, but remember this is after your house and car payments and anything else like a boat you are financing.

Savings + investing = Your Key to Financial Independence

The old rule was to save 10% of your income and that may still work if you start investing in your 20s or 30s… But depending on your age and current savings level, 10% probably isn’t enough, especially for ODs not building equity in a sale-able practice. Creating a meaningful nest egg for retirement will probably require saving 20% or more of your pre-tax profits, (in this case is $60,000 per year, or 20% X $300,000).

Creating Wealth Is a Long-term Process

Achieving financial independence over and above your practice income is a long term process which does not happen overnight, even for ODs who plan well. Creating an intentional plan with frequent updates based on life circumstances is the real formula for success.

Disclaimer: This material is for educational and informational purposes only to the best of the author’s knowledge and is not to be construed as personalized financial or investment advice. Consult a financial professional about your personal situation.

Email your questions for Money Talk to mbijlefeld@jobson.com.

Email your questions for Money Talk to mbijlefeld@jobson.com.

Natalie Hayes Schmook, MBA, Certified Financial Planner™, Certified Valuation Analyst™, is the founder and owner of Hayes Wealth Advisors, a financial planning and investment management service for practice owners and their families.

Missed previous Money Talk installments?

Investing 201: Types of Investment Vehicles

Investing 101: Understanding Stocks Through Positioning

Three Things You Should Know About 529 Plans

Needs = Taxes, Debt and Electricity

The 50/30/20 Approach for Personal Budgeting

Do You Have the Right Liability Insurance?

The 1% Trick That Will 100% Help Your Retirement Goals

The Student Loan Conundrum: To Refinance or Not to Refinance

Is Your Portfolio On Track For Retirement? Use The 4% Rule

Personal Spending Is A Mission-Critical Piece To Retirement Planning