By Natalie Hayes Schmook, MBA, CFP, CVA

When I talk about the stock market, eyes sometimes quickly glaze over because investment professionals tend to use words that don’t mean much to the average investor. Like optometry, investment terminology can sound like a different language, but there are some basic terms that cover much of how the stock market is broken down.

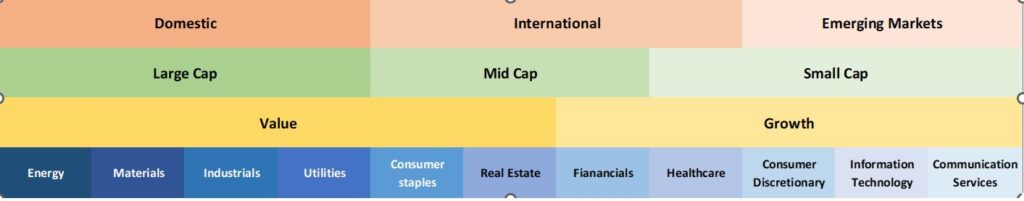

Geographic Location

One of the first things to look at is where an investment is located. Being located in the United States versus another country may have different government, legal, tax or labor market ramifications. The United States generally looks at domestic and developed markets (Europe, Australia and Japan) and emerging markets (the rest of the world). But just because a company is based in the United States doesn’t mean it won’t have international exposure. Most, if not all large U.S. companies have significant international operations.

Company Size

Company size is known as “market capitalization.” Generally these are segmented into Large, Mid and Small cap stocks, although some additional segments include Mega Cap and Micro Cap. Market capitalization is determined by the price per share multiplied by the number of shares outstanding. As of June 2022, Apple has the largest market cap in the world at $2.85 trillion. Bigger companies tend to be more stable in their price and operations than smaller companies, while smaller companies tend to have more room to grow or get acquired.

Value versus Growth

Most stocks are categorized as either a value company or a growth company based on where they are in their business cycle. For example, Coca Cola is generally considered a value company. They have market saturation in the beverage industry, and while they continue to grow through acquisitions, they are primarily generating income through their core business operations and distributing those profits to shareholders through a dividend. Tesla, on the other hand, is set to disrupt the world of batteries in all kinds of applications through game-changing technology. And some people think they’re just an electric car company!

Sector

All stocks are broken out into 11 sectors that are pretty self-explanatory. Different sectors tend to perform differently depending on what’s going on in the world. For example, financial institutions tend to perform poorly during a recession due to fears that companies and people won’t be able to repay their debt in adverse market conditions.

These factors and more are ones that determine the performance and long-term growth of an investment portfolio. Stay tuned for next month’s Investment 101 to learn how to take this knowledge and implement it in your own investment portfolio!

Email your questions for Money Talk to mbijlefeld@jobson.com.

Email your questions for Money Talk to mbijlefeld@jobson.com.